Finding the right auto insurance can be tough. But GAINSCO Auto Insurance makes it easier. They offer affordable plans that fit your needs and budget. Whether you need liability, comprehensive, or both, GAINSCO has you covered.

They are known for their great rates and service. This makes them a top choice for auto insurance.

Key Takeaways

- GAINSCO offers affordable and customizable auto insurance plans for drivers in the United States.

- The company provides a range of coverage options, including liability, collision, and comprehensive protection.

- GAINSCO is committed to providing exceptional customer service and competitive rates to its policyholders.

- Drivers can easily obtain car insurance quotes and manage their policies through GAINSCO’s user-friendly online tools.

- GAINSCO caters to both standard and high-risk drivers, ensuring that everyone has access to reliable auto coverage.

Understand the Importance of GAINSCO Auto Insurance

Car insurance is not just a luxury; it’s a legal must in most places. Getting quality auto coverage from GAINSCO offers great protection against the unexpected. It keeps your finances safe and your mind at ease while driving.

Why Auto Insurance is a Necessity

Most states require you to have auto liability insurance. It covers the costs of damages or injuries you might cause in an accident. Without it, you could face big expenses and even legal trouble. GAINSCO’s wide range of coverage options gets you ready for the road.

The Benefits of Comprehensive Coverage

- Liability Protection: GAINSCO’s liability coverage shields you from financial loss if you’re at fault in an accident. It covers property damage or injuries to others.

- Collision Deductibles: GAINSCO’s collision coverage helps pay for your car’s repairs after an accident. You can choose a deductible that fits your budget.

- Roadside Assistance: GAINSCO’s roadside assistance is there when you need it. It helps with flat tires, dead batteries, and more.

With a GAINSCO auto insurance policy, you can drive with confidence. You’ll be protected from the financial shocks that can come from unexpected road events.

Explore GAINSCO’s Competitive Rates

Finding good auto insurance that’s affordable is key. GAINSCO Auto Insurance aims to offer rates that fit different budgets. They serve drivers all over the United States.

GAINSCO focuses on custom solutions to keep rates low. They know every driver is different. Their team works hard to create coverage that’s both effective and affordable.

| Coverage Type | Average Monthly Rate* |

|---|---|

| Liability Coverage | $79 |

| Collision Coverage | $102 |

| Comprehensive Coverage | $65 |

*Rates may vary based on location, driving history, and other factors.

GAINSCO uses their experience and data to keep rates low. This way, drivers get the coverage they need without breaking the bank.

“GAINSCO’s commitment to affordability has been a game-changer for me. I was able to find a policy that fit my budget without compromising on crucial protection.” – John Doe, GAINSCO Auto Insurance customer

Want to see GAINSCO’s rates and find the right coverage for you? Visit their website or talk to an agent today.

Customizable Coverage Plans

At GAINSCO Auto Insurance, we know every driver is different. That’s why we offer many options for your vehicle coverage. This way, you get the protection you need.

Liability Protection for Peace of Mind

Our liability protection is a key part of our plans. It helps protect you from the cost of damages or injuries you might cause in an accident. With GAINSCO, you can pick the right amount of liability coverage for you. This gives you peace of mind while driving.

Collision and Comprehensive Options

We also have many options for collision and comprehensive coverage. These plans help pay for repairs or a new car if it’s stolen or damaged. You can choose what fits your needs best, keeping your vehicle coverage plans affordable.

At GAINSCO, we want our customers to feel secure on the road. Our customizable plans offer the liability protection and collision deductibles you need. And we do it at a price you’ll like.

“GAINSCO’s customizable coverage plans gave me the flexibility to tailor my policy to my unique driving needs. I feel confident knowing I have the liability protection and collision deductibles I need to stay safe on the road.”

– John Smith, GAINSCO customer

Discounts and Rewards for Safe Drivers

At GAINSCO, we reward our customers for driving safely. We offer discounts and rewards to help you save on auto insurance. This way, safe drivers can enjoy lower costs.

Multiple Vehicle Discounts

Insuring more than one vehicle with GAINSCO gets you a special discount. This discount can greatly reduce your premium. It makes it easier to protect your family’s cars.

Safe Driver Rewards Program

GAINSCO’s Safe Driver Rewards Program rewards safe driving. Keep your driving record clean and avoid accidents. You’ll earn points for rewards like gift cards, merchandise, or discounts on future renewals.

| Discount Type | Discount Amount |

|---|---|

| Multiple Vehicle Discount | Up to 25% off |

| Safe Driver Rewards Program | Varying discounts and rewards |

Use these gainsco discounts and safe driver rewards to save on auto insurance. You’ll get the coverage you need while keeping costs down.

GAINSCO Auto Insurance for High-Risk Drivers

At GAINSCO, we know not all drivers are the same. That’s why we have gainsco auto insurance for high-risk drivers. We make sure they get the coverage they need at good prices.

High-risk drivers often find it hard to get auto insurance. They might pay more or even get turned down. But GAINSCO is different. We work with these drivers to find the right coverage for them.

- Coverage for drivers with poor driving records, including accidents, tickets, or DUIs

- Policies for those with limited or no prior insurance history

- Flexible payment plans and options to help manage costs

- Personalized guidance to navigate the insurance landscape

GAINSCO focuses on the needs of high-risk drivers. We aim to provide gainsco auto insurance that’s both protective and affordable. Our goal is to help these drivers feel confident on the road again.

“GAINSCO understood my unique situation and worked with me to find an affordable policy that fit my needs. I’m grateful for their support and commitment to helping high-risk drivers like myself.”

If you’re a high-risk driver looking for reliable gainsco auto insurance, check out what we offer. See how we can help you feel confident on the road again.

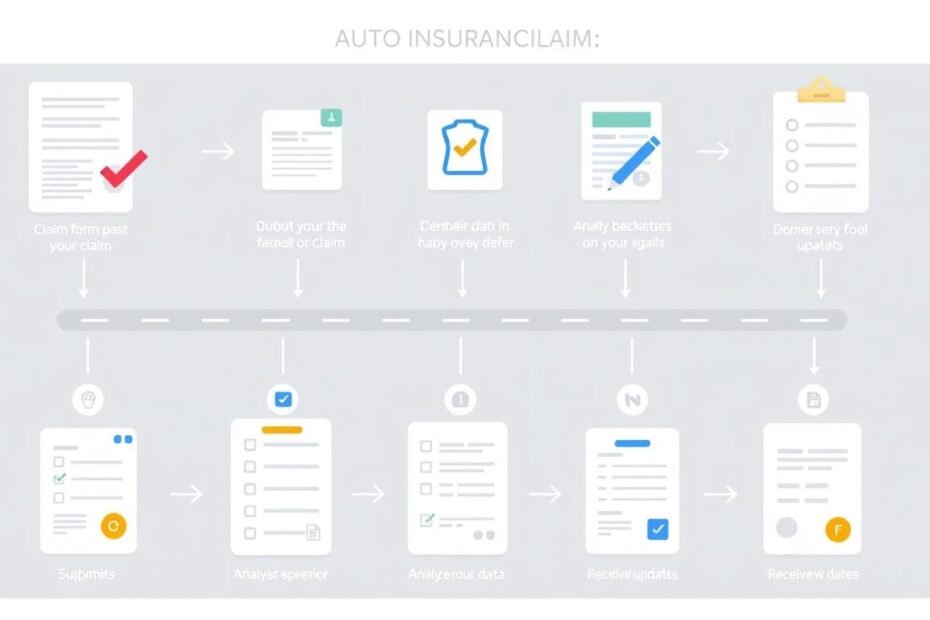

The Claims Process Made Easy

At GAINSCO Auto Insurance, we know insurance claims can be tough. That’s why we’ve made our claims process easy and stress-free. If you need to file a claim for an accident, theft, or any other covered incident, our team is here to help.

Filing a Claim with GAINSCO

Starting a claim with GAINSCO is easy. You can call our 24/7 claims hotline or use our online portal. Our experienced team will review your case and keep you updated every step of the way. We aim to resolve your claim quickly and to your satisfaction.

Roadside Assistance Services

Unexpected car troubles can happen anytime. That’s why GAINSCO offers roadside assistance services to our policyholders. Need a jump-start, tire change, or tow? Our reliable service providers are ready to help and get you moving again safely.

| Roadside Assistance Services | Included with GAINSCO Policy |

|---|---|

| Towing | ✓ |

| Flat Tire Change | ✓ |

| Jump-Start | ✓ |

| Fuel Delivery | ✓ |

| Lockout Assistance | ✓ |

With GAINSCO’s gainsco claims process and roadside assistance, you’re in good hands. We’re here to support you and get you back on the road safely and efficiently.

Comparing GAINSCO to Other Providers

When looking for gainsco auto insurance, comparing providers is key. This ensures you get great coverage at a good price. GAINSCO Auto Insurance is known for its unique features and focus on customers.

GAINSCO is great because it offers car insurance quotes that are both affordable and high-quality. It’s different from some companies that seem cheap but have hidden costs or less coverage. GAINSCO is clear about its prices and what you get, helping you choose wisely.

| Feature | GAINSCO | Other Providers |

|---|---|---|

| Rates | Competitive, with a focus on affordability | Vary, some may offer lower base rates but have hidden fees |

| Coverage Options | Comprehensive, with customizable plans | May have limited coverage options or less flexibility |

| Customer Service | Highly rated, with responsive and helpful support | Quality may vary among providers |

| Discounts | Multiple discounts available for safe drivers | Discount offerings may be more limited |

GAINSCO also shines in customer service, with a quick claims process and roadside help. These benefits offer comfort and help when you need it, making GAINSCO stand out.

In the end, gainsco auto insurance beats others with its low prices, wide coverage, and top-notch service. It’s a top pick for those looking for reliable and flexible auto insurance.

Online Tools for Quotes and Policy Management

GAINSCO Auto Insurance knows how important it is to make things easy for its customers. That’s why they offer online tools to make getting car insurance simple. You can get personalized quotes by visiting their website and sharing some basic info about your car and driving history.

Managing your auto insurance policy is also easy with GAINSCO’s online platform. You can check your policy, pay bills, and even change your coverage online. This makes it simple for customers to handle their insurance needs whenever they want.

Looking for a new car insurance policy or need to update your current one? GAINSCO’s online tools make it easy. You can get quotes and manage your policy online. This way, you can take care of your insurance needs without dealing with a lot of paperwork or visits.

FAQ

What is GAINSCO Auto Insurance?

GAINSCO Auto Insurance is a top choice for car insurance in the U.S. They offer great rates, plans you can customize, and focus on making customers happy.

Why is auto insurance important?

Auto insurance is a must in most states. It protects you and your car in accidents or unexpected events. It covers liability, collision, and more.

How does GAINSCO’s auto insurance rates compare to other providers?

GAINSCO’s rates are often lower than big names. They aim to give great value to their customers.

What types of coverage plans does GAINSCO offer?

GAINSCO has plans for different needs. You can choose from liability, collision, and comprehensive coverage. They have options for all drivers.

What discounts and rewards does GAINSCO provide for safe drivers?

Safe drivers get perks from GAINSCO. They offer discounts for multiple cars and a rewards program. These help you save money and drive safely.

Does GAINSCO provide coverage for high-risk drivers?

Yes, GAINSCO has plans for high-risk drivers. They work with these drivers to find the right coverage.

How does the GAINSCO claims process work?

GAINSCO’s claims process is easy and fast. You can file a claim quickly. They also offer roadside help when you need it.

How does GAINSCO compare to other auto insurance providers?

GAINSCO stands out with its low rates, flexible plans, and rewards. They focus on excellent customer service and a unique insurance experience.

What online tools does GAINSCO provide for managing auto insurance policies?

GAINSCO has online tools for easy policy management. You can get quotes, manage your policy, and stay updated on your coverage. Their platforms are easy to use.